With Valentine’s Day around the corner, it’s time to spotlight the top contenders in the world of dating apps, where love meets mobile innovation.

Leading the list is Bumble, taking the first position with its solid performance across ASO, Apple Search Ads, and Ad Intel scores. Following closely is Tinder, which secured the second spot with its impressive ASO score and highlighted its strategic organic visibility. Pure Dating grabs third place, boasting the highest Apple Search Ads score, which is attributed to its targeted keyword bidding and innovative use of custom product pages. Meanwhile, Badoo takes the fourth spot as the highest Ad Intelligence score holder, demonstrating a keen eye for quality over quantity in their ad creatives.

Now, let’s delve into the main highlights, examining how these leading dating apps have managed to surpass their rivals.

Bumble

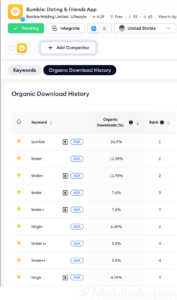

- Their ASO performance indicates a strong presence, ranking for over 53,000 keywords organically, with 41% of them landing in the top 30. Interestingly, they attract more than 60% of their organic downloads from competitor brand keywords, indicating a smart approach to acquiring users.

Keyword Intelligence of Bumble

- Regarding Apple Search Ads, they are actively bidding on 582 keywords, indicating a proactive strategy to increase visibility. They’ve also introduced 8 custom product pages over the year focused on competitor keywords, highlighting app features, and tapping into seasonal trends or social causes.

CPP by App – Bumble

- They have a very dynamic ad strategy, with over 300 creatives produced in the last month, 191 of which are currently live. They use live footage effectively, generating higher impressions than the category average. Their distribution strategy involves multiple ad networks and DSPs, and while image ads are their top choice, they also create playable formats, offering a unique and engaging approach.

Tinder

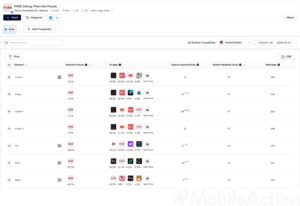

- They stand out as the highest ASO score holder in the list, organically ranking with over 60,000 keywords. Notably, they’ve capitalized on over 4,000 brand keywords, with 40 belonging to their own brand, showcasing a strategic emphasis on competitor brand keywords. Remarkably, Tinder drives over 99% of its organic downloads through its brand keywords, underscoring the formidable presence of its brand within the category.

Tinder organically ranked for 60,052 keywords, with 612 of them achieving the top position

- Tinder is active on over 800 keywords for their search result ads, targeting both their own and competitor brand keywords. This proactive approach to keyword targeting contributes to their visibility and user acquisition efforts.

PURE Dating

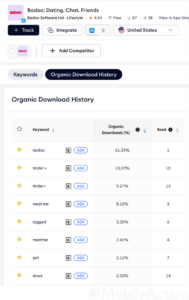

- PURE Dating stands out with its organic performance that positions, securing organic rankings for over 8,000 keywords. Over 60% of their organic downloads from two competitor brand keywords (tinder & hinge) showcasing effective targeting strategies.

The organic download history of PURE Dating

- They demonstrate a strong presence in Apple Search Ads, actively bidding on nearly 5,000 keywords, including their own brand, generic category keywords, and competitor brand terms. Additionally, they’ve leveraged custom product pages to enhance their paid user acquisition efforts, creating 12 variations tailored to their user base demographics. This combined approach earns PURE Dating the highest Apple Search Ads score in the list.

PURE Dating is currently bidding on over 4,900 keywords for their search result ads.

- In the past month, PURE Dating has produced 34 ad creatives, with 17 currently live across 4 main ad networks. Their ad visuals primarily feature screenshots from the app’s user interface, ensuring relevance and authenticity. While video ads are their top choice, they also incorporate image and banner ads, diversifying their ad format to reach their audience effectively.

Badoo

- Badoo currently ranks organically for over 27,000 keywords. While the majority of their organic downloads come from their own brand keyword, accounting for over 55%, they’ve also managed to secure 20% from a competitor’s brand keyword.

The organic download history of Badoo

- They adopt a unique approach to paid user acquisition. On Apple Search Ads, they focus on bidding for a select few keywords, notably avoiding their brand keywords and instead targeting generic keywords related to the app’s features, such as “meet,” “chat,” and “flirt.”

- Similarly, Badoo’s advertising strategy emphasizes quality over quantity. Despite having fewer ad creatives than the category average, consisting of video and banner formats, their ads significantly outperform others. This approach earns them the highest Ad Intelligence score in the list, highlighting the importance of strategic advertising tactics.

OkCupid

- They currently rank for over 20,000 keywords organically, with 70% of their organic downloads originating from competitor keywords, showcasing a strategic approach to user acquisition.

ASO Report of OkCupid

- OkCupid is actively bidding on more than 300 keywords, with over 35% achieving higher impressions than 10%. Moreover, they’ve implemented a custom product page strategy alongside their default page, resulting in increased impressions. These custom product pages have additional keywords, tailored visual assets, and messaging to enhance engagement.

- OkCupid distributes 17 ads across 4 ad networks, mainly in image format but also including video and banner ads. OkCupid effectively captures user attention and engagement by utilizing live footage in their ads, a common preference among dating apps.

Observations in the Dating App Landscape

Inclusivity and the rise of niche communities are two prominent trends shaping the dating app industry. Dating platforms are increasingly focused on creating inclusive environments that involve users from diverse backgrounds, including race, religion, and sexual orientation.

With the rise of targeted dating apps, a competitive landscape has emerged within the dating category. Understanding your target audience, analyzing competitor strategies, and deciding how to position your app in the market have become essential considerations for maintaining or establishing your presence.

Race and Ethnicity

As part of their commitment to inclusivity, dating apps prioritize representation and inclusiveness for users of all racial and ethnic backgrounds. By introducing features and functionalities that acknowledge and address the unique experiences of diverse communities, these platforms aim to create welcoming spaces where individuals feel valued and understood.

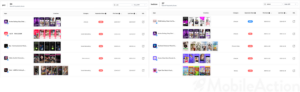

Identify your competitors that are aiming for the same target audience as you by using Keyword Analysis.

By leveraging MobileAction features such as Keyword Analysis, you can identify competitors targeting your selected keywords on both organic and paid sides. Additionally, utilizing the Creative Asset Hub enables you to compare and comprehend how your messaging and presentation stack up against others in the market.

Compare your visual assets to your competitors and understand their messaging strategies with Creative Asset Hub.

Religion

Religious diversity is another key focus area for dating apps striving to create inclusive environments. Platforms are adapting to accommodate users from various religious backgrounds and beliefs, offering features and tools that serve the specific needs and preferences of individuals seeking partners who share their religious values.

By creating spaces where individuals can connect with like-minded individuals within their faith community, dating apps facilitate meaningful connections and relationships.

Custom product pages targeted towards the term “christian mingle.”

To target the appropriate audience and convert them into high-intent users, specialized apps such as those focusing on religion-based dating can utilize custom product pages for their search result ads, displaying precisely what users seek. “Christian Mingle” stands as a widely used and directly relevant search term within the dating market. With MobileAction’s CPP Intelligence, you gain access to a comprehensive list of apps targeting your desired search term, allowing you to analyze their creative arrangements for that keyword. This enables you to identify potential competitors and understand their targeting strategies.

To entice users to return to their apps, religion-oriented dating platforms can capitalize on special holidays and seasonal periods associated with the faith they originate from. By doing so, they can enhance their app’s credibility and tap into users’ desire to find matches who share similar values and priorities in life.

In-App Events created by InshAllah Muslim Dating app around religious holiday seasons of Islam.

Sexual Orientation and Identity

In response to the diverse spectrum of sexual orientations, dating apps are taking steps to ensure that all users feel welcome and represented. From inclusive profile options to tailored matchmaking algorithms, these platforms provide a safe and inclusive space for individuals to explore and express their sexuality.

By incorporating features to the diverse needs and preferences of users across the LGBTQ+ spectrum, dating apps empower individuals to find acceptance, connection, and love on their own terms.

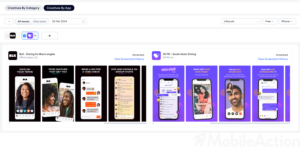

Custom product pages created for keyword “gay” and “lesbian”

To enhance targeting efforts, dating apps catering to niche audiences can develop tailored product pages for keywords they believe their most interested users would utilize to discover their app. Terms such as “gay” and “lesbian,” which hold significant search scores among certain users, are strategically employed by queer dating apps in their custom product pages.

Valentine’s Day Trends: Insights and Expectations for the Mobile App Industry

Valentine’s Day has a strong impact on the mobile app industry. As observed, there’s a significant surge in search volume for keywords related to Valentine’s Day and romance in February.. This trend isn’t limited to dating apps; categories such as photo & video and entertainment also experience notable effects.

Around Valentine’s Day, we observe a notable increase in in-app events and promotional content. Dating apps facilitate connections, while photo & video apps offer tools for capturing and sharing cherished moments. Entertainment apps generate romantic playlists and movie selections, and gaming apps introduce special challenges for players to enjoy with their partners. This surge in activity not only addresses the season’s heightened popularity but also demonstrates app developers’ adaptability and creativity in meeting user expectations during key seasonal times like Valentine’s Day.

In-App Events around Valentine’s Day

As evident from last year’s trends, apps have effectively leveraged this seasonal opportunity, and it’s something we should anticipate seeing again this year.

Let’s take a look at their current initiatives for this year. Hily Dating App has already begun preparations for Valentine’s Day, setting up two in-app events centered around the occasion.

The full view of before, during, and after analysis of Hily Dating App’s In-App Events.

By leveraging Compass’ Impact feature, we can discern a significant surge in their organic visibility, signifying the successful implementation of these in-app events during this seasonal period. Additionally, once the in-app event expires, we can assess the event’s full impact on the app’s visibility throughout its entire duration and after February 14.

Wondering how your app measures up against competitors in the market? MobileAction provides a valuable resource for thorough competitor analysis, allowing you to effectively grasp market trends and refine your strategy. Schedule a demo with MobileAction today to gain additional insights and strengthen your position in the market.

Methodology

The ranking of top advertisers is determined by analyzing ASO Scores, Apple Search Ads Scores, and Ad Intelligence Scores obtained from MobileAction’s extensive dataset.

This in-depth analysis has been made possible through MobileAction’s offerings, including Apple Search Ads campaign management and comprehensive app store marketing intelligence. Our platform actively tracks over 5 million keywords, providing invaluable insights, and boasts a library of 69+ million ad creatives from 50+ ad networks globally. These impactful features strengthen our analyses by tapping into a wealth of data from diverse apps and creative strategies, ensuring a comprehensive and insightful examination of the advertising landscape within the dating app industry.